-

Home > News > Industry News

Glass Electrical Insulators: The Unsung Heroes of Modern Power Grids-02

Glass Electrical Insulators: The Unsung Heroes of Modern Power Grids-02

6. Comparative Analysis: Glass vs. Other Insulator Materials

The choice of insulator material is a critical engineering decision that depends on a variety of factors, including the specific application, environmental conditions, and economic considerations. The three main types of insulator materials used in high-voltage applications are glass, ceramic (porcelain), and polymer (composite). Each of these materials has its own unique set of advantages and disadvantages, which are summarized in the table below.

Table 2: Comparative Anal ysis of Insulator Materials*

| Feature | Glass Insulators | Ceramic (Porcelain) Insulators | Polymer (Composite) Insulators |

| Mechanical Strength | High compressive and tensile strength, resistant to impact | High compressive strength, but more brittle than glass | High tensile strength (from fiberglass core), but susceptible to damage from vandalism |

| Electrical Performance | High dielectric strength, low dielectric loss, high flashover voltage | High dielectric strength, good electrical performance | Good electrical performance, but can be affected by pollution and moisture |

| Weight | Heavy | Heavy | Lightweight, which simplifies handling and installation |

| Failure Mode | Shatters completely, making failure immediately obvious | Can develop internal cracks that are not visible, leading to hidden failures | Can fail due to tracking or erosion, which may not be immediately visible |

| Maintenance | Low maintenance due to transparency and predictable failure mode | Requires periodic testing to detect internal failures | Requires periodic cleaning in polluted environments |

| Cost | Moderate initial cost, low lifecycle cost | Moderate initial cost, moderate lifecycle cost | Low initial cost, but higher lifecycle cost due to shorter service life |

| Environmental Impact | Fully recyclable, made from natural materials | Fully recyclable, made from natural materials | Difficult to recycle, made from synthetic materials |

6.1 Glass vs. Ceramic (Porcelain) Insulators

Glass and ceramic (porcelain) insulators have been the two traditional materials used in high-voltage applications for many decades. Both materials offer excellent electrical and mechanical properties, but they also have some key differences that can influence the choice of material for a particular application.

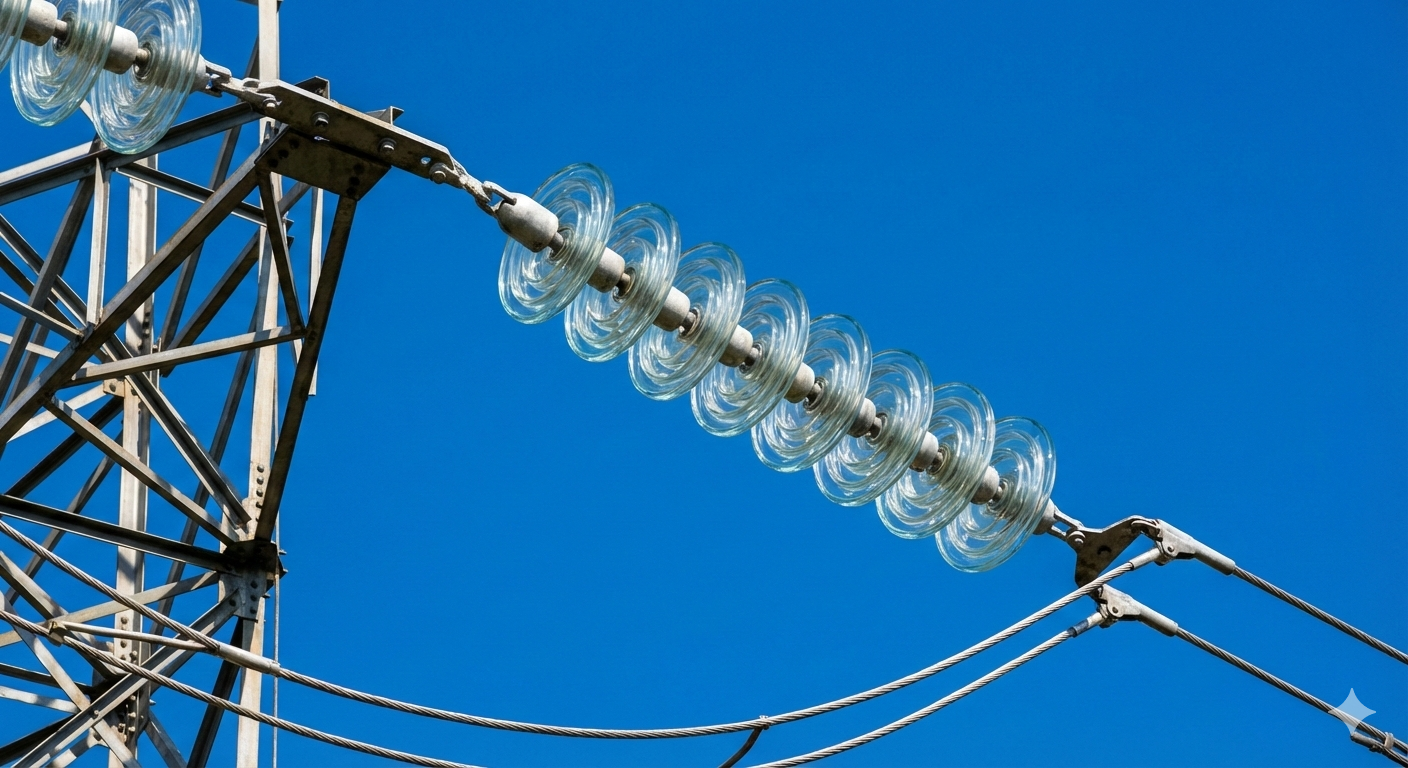

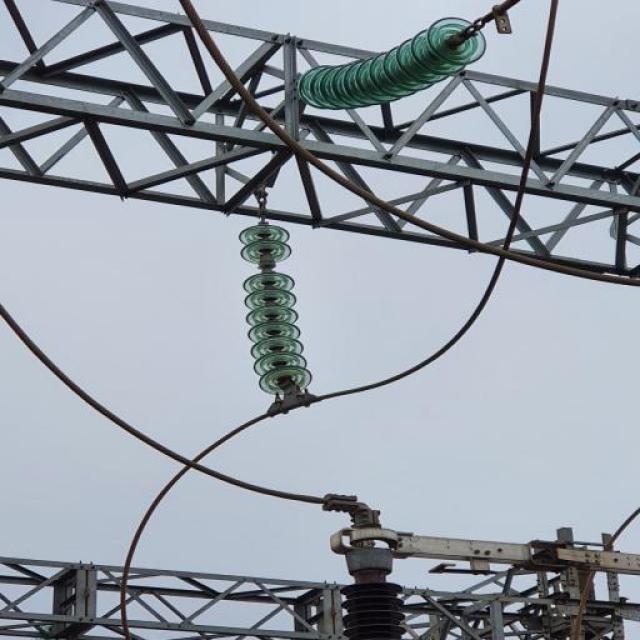

6.1.1 Mechanical Strength and Brittleness

Both glass and porcelain insulators have high mechanical strength, but glass insulators, particularly those made from toughened glass, often have a higher compressive strength than their porcelain counterparts. This makes them more resistant to the mechanical loads imposed by heavy conductors and severe weather conditions. However, both materials are brittle and can be damaged by impact. The key difference is in their failure mode. When a glass insulator fails, it shatters completely, making the failure immediately obvious. In contrast, a porcelain insulator can develop an internal crack that is not visible from the outside, creating a hidden "zero-value" insulator that can lead to a catastrophic failure without warning.

6.1.2 Electrical Performance and Weather Resistance

Both glass and porcelain insulators have excellent electrical properties, including high dielectric strength and high resistivity. They are both capable of withstanding high voltages and providing reliable electrical insulation. However, the smooth, non-porous surface of glass insulators can provide better performance in polluted environments, as it is more difficult for contaminants to adhere to the surface. This can reduce the risk of flashover and the need for frequent cleaning. Both materials are also highly resistant to environmental aging, including UV radiation and chemical attack.

6.1.3 Weight and Installation Considerations

Glass and porcelain insulators are both relatively heavy, which can make handling and installation more difficult and costly than for polymer insulators. The weight of the insulators must be taken into account in the design of the transmission towers and other supporting structures. However, the high mechanical strength of glass and porcelain insulators allows them to be used in applications with high mechanical loads, which can be an advantage in some situations.

6.1.4 Failure Modes and Maintenance

The most significant difference between glass and porcelain insulators is their failure mode. The self-shattering failure mode of glass insulators is a major safety advantage, as it makes failures immediately obvious and allows for quick replacement. This can reduce the need for costly and time-consuming testing to detect internal failures. In contrast, porcelain insulators can develop hidden internal defects that can be difficult to detect without specialized equipment. This can lead to a higher risk of unexpected failures and can increase the maintenance requirements for porcelain insulators.

6.2 Glass vs. Polymer (Composite) Insulators

Polymer (composite) insulators are a newer technology that has gained significant market share in recent decades. They offer a number of advantages over traditional glass and porcelain insulators, but they also have some disadvantages that must be considered.

6.2.1 Weight and Handling Advantages of Polymer

The most significant advantage of polymer insulators is their light weight. They are typically much lighter than glass or porcelain insulators of the same voltage rating, which can simplify handling, transportation, and installation. This can lead to significant cost savings, particularly in remote or inaccessible locations. The light weight of polymer insulators can also reduce the mechanical loads on transmission towers and other supporting structures.

6.2.2 Hydrophobicity and Pollution Performance

The polymer housing of composite insulators, which is typically made of silicone rubber, is hydrophobic, meaning that it repels water. This can provide excellent performance in polluted and wet environments, as it prevents the formation of a continuous water film on the surface of the insulator. This can reduce the risk of flashover and the need for frequent cleaning. However, the hydrophobicity of the polymer can be lost over time due to environmental aging, which can reduce the performance of the insulator.

6.2.3 Long-Term Aging and UV Resistance

One of the main disadvantages of polymer insulators is their susceptibility to long-term aging. The polymer housing can be degraded by UV radiation from the sun, which can cause it to become brittle and crack. This can compromise the mechanical and electrical integrity of the insulator and can lead to a shorter service life than for glass or porcelain insulators. The long-term performance of polymer insulators is still a subject of ongoing research, and their use in critical applications is often subject to strict qualification requirements.

6.2.4 Cost and Lifecycle Comparison

Polymer insulators typically have a lower initial cost than glass or porcelain insulators. However, their shorter service life and higher maintenance requirements can result in a higher lifecycle cost. The choice of insulator material must therefore be based on a careful analysis of both the initial cost and the long-term costs of ownership.

7. Glass Insulators in the Future Grid

7.1 The Smart Grid Revolution

The development of the smart grid is creating new opportunities for the use of glass insulators. The smart grid is a modernized electrical grid that uses information and communication technologies to improve the efficiency, reliability, and sustainability of the power system. Glass insulators can play a key role in the smart grid by providing a platform for the integration of sensors and other monitoring devices.

7.1.1 Integration of Sensors for Real-Time Monitoring

The transparency and robustness of glass insulators make them an ideal platform for the integration of sensors for real-time monitoring of the power grid. These sensors can be used to measure a variety of parameters, such as voltage, current, temperature, and mechanical load. This data can be used to provide a real-time picture of the health of the grid and to identify potential problems before they lead to failures. The integration of sensors into glass insulators is a key area of research and development, and it is expected to lead to significant improvements in the reliability and efficiency of the power grid.

7.1.2 Predictive Maintenance and Grid Reliability

The data from the sensors integrated into glass insulators can be used to implement predictive maintenance strategies. Predictive maintenance is a proactive approach to maintenance that uses data analysis to predict when equipment is likely to fail. This allows utilities to schedule maintenance activities before a failure occurs, which can reduce downtime and improve the reliability of the power grid. The use of predictive maintenance is a key component of the smart grid, and glass insulators with integrated sensors are expected to play a major role in this area.

7.1.3 Role in High-Voltage Direct Current (HVDC) Transmission

High-voltage direct current (HVDC) transmission is a key technology for the future grid, as it allows for the efficient transmission of large amounts of power over long distances. HVDC transmission is particularly well-suited for connecting remote renewable energy sources, such as wind and solar farms, to the main power grid. Glass insulators are well-suited for HVDC applications, as they have excellent electrical properties and are resistant to the effects of pollution. The development of new glass insulator designs specifically for HVDC applications is a key area of research and development.

7.2 Sustainability and Environmental Impact

The growing focus on sustainability is creating new opportunities for the use of glass insulators. Glass is a natural, inert, and fully recyclable material, which makes it an environmentally friendly choice for power transmission applications.

7.2.1 The Recyclability of Glass Insulators

One of the key advantages of glass insulators is their recyclability. At the end of their service life, glass insulators can be crushed and recycled into new glass products, or they can be used as aggregate in construction materials. This reduces the amount of waste that goes to landfills and conserves natural resources. The recyclability of glass insulators is a major advantage over other types of insulators, such as polymer insulators, which are more difficult to recycle.

7.2.2 Comparing Carbon Footprints: Glass vs. Alternatives

The carbon footprint of a product is a measure of the total greenhouse gas emissions associated with its production, use, and disposal. The carbon footprint of glass insulators is relatively low, as they are made from natural materials and are fully recyclable. In contrast, the carbon footprint of polymer insulators is higher, as they are made from synthetic materials that are derived from fossil fuels. The use of glass insulators can therefore help to reduce the overall carbon footprint of the power grid.

7.2.3 Innovations in Eco-Friendly Manufacturing

The glass insulator industry is continuously working to reduce the environmental impact of its manufacturing processes. This includes the use of recycled glass (cullet) in the production of new insulators, which reduces the amount of energy required for melting. The industry is also exploring the use of alternative energy sources, such as solar and wind power, to reduce its reliance on fossil fuels. These innovations are helping to make the production of glass insulators even more sustainable.

7.3 Meeting the Demands of Renewable Energy

The rapid growth of renewable energy is creating new challenges and opportunities for the power grid. The integration of large amounts of intermittent renewable energy sources, such as wind and solar power, requires a more flexible and resilient grid. Glass insulators can play a key role in meeting these challenges.

7.3.1 Supporting Long-Distance Power Transmission

Many of the best renewable energy resources are located in remote areas, far from the main centers of population. This requires the construction of new long-distance transmission lines to deliver the power to where it is needed. Glass insulators are well-suited for these applications, as they have excellent electrical properties and are resistant to the effects of pollution. The use of glass insulators can help to ensure the reliable and efficient transmission of renewable energy over long distances.

7.3.2 Performance in Harsh Environmental Conditions

Renewable energy projects are often located in harsh environmental conditions, such as deserts, mountains, and coastal areas. These environments can be challenging for electrical equipment, and they require insulators that are durable and reliable. Glass insulators are well-suited for these applications, as they are resistant to UV radiation, temperature extremes, and corrosion. The use of glass insulators can help to ensure the long-term performance and reliability of renewable energy projects.

8. Global Market Analysis and Regional Trends

The global market for glass electrical insulators is a dynamic and expanding sector, driven by a confluence of factors including rising global electricity demand, the urgent need for grid modernization, and the global shift towards renewable energy sources. Market analyses from various research firms project a steady and significant growth trajectory for the industry over the next decade. While specific valuations and growth rates vary slightly between reports due to different methodologies and market definitions, a clear consensus emerges on the market's positive outlook.

For instance, one report values the global glass insulators market at approximately **USD 1.2 billion in 2024**, with a projected compound annual growth rate (CAGR) of **5.6%** over the subsequent 5 to 10 years .

Another comprehensive analysis from Market Research Future provides a more detailed valuation, estimating the market at **USD 1,031.97 million in 2022** and forecasting it to reach **USD 1,696.49 million by 2032**, growing at a CAGR of **5.12%** from 2023 to 2032 . This growth is further corroborated by other studies that place the market size at **USD 2.5 billion in 2024**, with a forecast to reach **USD 4.1 billion by 2033** at a CAGR of **6.0%** . These figures underscore the robust demand for glass insulators as critical components in the development and maintenance of reliable and efficient power systems worldwide.

The market's expansion is not uniform across the globe, with certain regions emerging as key growth centers. The Asia-Pacific region, in particular, stands out as the dominant and fastest-growing market for glass insulators. This is largely attributed to rapid industrialization, urbanization, and massive investments in power infrastructure in countries like China and India . In 2022, the Asia-Pacific region accounted for a market value of **USD 473.44 million**, and this is projected to surge to **USD 797.01 million by the end of the forecast period**, reflecting a significant CAGR of **5.4%** . North America and Europe also represent substantial markets, characterized by a focus on modernizing aging grid infrastructure and integrating renewable energy sources. The North American market, valued at **USD 793.1 million in 2023**, is expected to grow at a CAGR of **5.1%** to reach **USD 1.2 billion by 2032** . The European market, while more mature, is driven by stringent environmental regulations and a strong emphasis on sustainability, fostering demand for durable and eco-friendly insulator solutions . The following sections provide a more detailed analysis of the market dynamics and trends in these key regions.

8.1 North American Market: Focus on Grid Modernization

The North American market for glass electrical insulators is a significant and mature segment of the global industry, characterized by a strong emphasis on upgrading and modernizing the existing power grid infrastructure. The market size was valued at **USD 793.1 million in 2023** and is projected to experience steady growth, with a compound annual growth rate (CAGR) of **5.1%** from 2024 to 2032, reaching an estimated value of **USD 1.2 billion by 2032**.

This growth is primarily fueled by a combination of factors, including the increasing demand for reliable electricity, the need to replace aging infrastructure, and the ongoing adoption of smart grid technologies. Government initiatives and substantial investments are playing a crucial role in driving this market expansion. For example, in August 2024, the U.S. Department of Energy announced a significant grid enhancement program, investing **USD 2.2 billion** across 18 states to fortify the electrical infrastructure against climate-related challenges, with key objectives including upgrading over 100 miles of transmission systems and integrating renewable energy sources . Such initiatives are creating a robust demand for high-performance insulators, including glass variants, that can ensure the stability and efficiency of the modernized grid.

The market in North America is also influenced by the region's commitment to renewable energy integration. As the U.S. and Canada continue to expand their wind and solar power generation capacities, there is a growing need for reliable transmission networks to transport this energy from remote generation sites to urban consumption centers. Glass insulators, known for their durability and performance in harsh environmental conditions, are well-suited for these applications. The U.S. market, in particular, is a major contributor to the region's overall growth. In 2024, the U.S. electrical insulation materials market was estimated at **USD 2.94 billion** and is projected to reach **USD 5.56 billion by 2034**, growing at a CAGR of **6.60%. This growth is supported by significant government funding, such as the **USD 13 billion** allocated for grid upgrades under the Bipartisan Infrastructure Law, which is expected to drive the demand for advanced electrical insulation materials. The presence of major industry players like Hubbell Power Systems, GE Grid Solutions, and MacLean Power Systems further strengthens the North American market, with these companies focusing on developing innovative solutions for grid modernization and smart grid applications.

8.1.1 Market Size and Growth Projections

According to a recent market research report, the North American high-voltage glass insulator market was valued at **USD 506.45 million in 2024** and is projected to reach **USD 606.16 million by 2030**, growing at a compound annual growth rate (CAGR) of **3.04%**. This steady growth reflects the ongoing investments in electrical transmission infrastructure and the continuous need for maintenance and upgrades. The market is expected to be driven by the increasing demand for reliable power delivery, the expansion of renewable energy capacity, and the replacement of aging equipment. While the overall market for electric insulators is larger and includes other materials like porcelain and polymer, the glass segment holds a significant share, particularly in high-voltage applications where its performance characteristics are highly valued. The consistent growth projection indicates a stable and predictable market for manufacturers and suppliers in the region.

8.1.2 Drivers: Aging Infrastructure and Renewable Integration

Two of the most significant drivers for the glass insulator market in North America are the aging power grid and the rapid expansion of renewable energy. Much of the electrical infrastructure in the United States and Canada was built decades ago and is now in need of significant upgrades and replacement. This includes the insulators on transmission lines, which can degrade over time due to environmental factors and electrical stress. As utilities undertake these modernization projects, they often choose to replace older porcelain or glass insulators with new, high-performance glass units that offer improved reliability and longevity. The second major driver is the integration of renewable energy sources, such as wind and solar power. These projects are often located in remote areas, requiring the construction of new long-distance transmission lines to deliver the power to population centers. Glass insulators are a preferred choice for these new lines due to their excellent performance in harsh environmental conditions and their ability to handle the high voltages required for efficient long-distance power transmission.

8.1.3 Key Players and Market Share

The North American glass insulator market is served by a mix of domestic and international manufacturers. Key players in the region include established companies like **MacLean Power Systems, Hubbell Incorporated, and Victor Insulators**, which have a long history of supplying the North American utility market . These companies have strong relationships with utility customers and a deep understanding of the regional standards and requirements. In addition to these domestic players, several international manufacturers, such as **Seves Group (Sediver), Nanjing Electric, and ZX Insulators**, also have a significant presence in the North American market. These companies often compete on the basis of product quality, technological innovation, and price. The competitive landscape is characterized by a focus on providing reliable, high-performance products that meet the stringent safety and reliability standards of the North American utility industry.

8.2 European Market: Emphasis on Sustainability

The European market for glass electrical insulators is characterized by a strong focus on sustainability, grid reliability, and the integration of renewable energy sources. The market is mature, with a well-established infrastructure, but it continues to grow steadily, driven by the need to refurbish and upgrade aging power networks and to meet ambitious green energy targets. In 2023, the Europe high voltage glass insulators market was valued at **USD 100.3 million** and is anticipated to grow at a CAGR of **6%** from 2024 to 2032. This growth is supported by favorable regulatory landscapes and significant investments in grid infrastructure projects. For instance, in March 2024, TenneT, a major transmission system operator in the Netherlands, announced plans to double its grid capacity investment over the next decade, with several infrastructure projects across the nation. Such initiatives are creating a consistent demand for high-quality insulators that can ensure the reliable and efficient transmission of electricity.

The European market is also shaped by stringent environmental regulations and a growing demand for eco-friendly and recyclable products. Glass insulators, which are made from natural materials and are fully recyclable, align well with these sustainability goals. This has led to an increased preference for glass insulators over other materials in certain applications. The market is also witnessing a trend towards the adoption of advanced technologies, such as smart insulators with integrated sensors for real-time monitoring and predictive maintenance. These technologies are helping to improve grid reliability and reduce operational costs. The market is dominated by established players like ABB, Siemens Energy, and Seves Group, who are focusing on developing high-voltage and technologically advanced insulators to meet the evolving needs of the European market. The demand for glass insulators is also driven by the expansion of cross-border transmission networks, which is essential for integrating renewable energy sources across the continent and ensuring a stable and secure supply of electricity.

8.2.1 Regulatory Landscape and Environmental Standards

The European Union has some of the most stringent environmental regulations in the world, and these regulations have a significant impact on the electrical industry. The EU's Green Deal and other climate policies are driving a massive investment in clean energy and grid infrastructure. This creates a favorable environment for the glass insulator market, as glass is a fully recyclable material with a long service life, aligning well with the principles of a circular economy. The European Committee for Electrotechnical Standardization (CENELEC) sets the standards for electrical equipment in Europe, and compliance with these standards is mandatory for products sold in the region. These standards ensure that insulators meet high levels of safety, performance, and environmental compatibility. The regulatory landscape in Europe is a key driver for innovation in the insulator industry, pushing manufacturers to develop more sustainable and high-performance products.

8.2.2 Demand for Green and Recyclable Products

The growing demand for green and recyclable products is a major trend in the European glass insulator market. Utilities and grid operators are increasingly looking for solutions that not only perform well but also have a minimal environmental footprint. Glass insulators are well-positioned to meet this demand, as they are made from natural raw materials and are 100% recyclable at the end of their service life. This is in contrast to some other types of insulators, which may contain materials that are more difficult to recycle or dispose of. The focus on sustainability is also driving innovation in manufacturing processes, with companies looking for ways to reduce energy consumption and waste during production. The demand for green products is expected to continue to grow in Europe, providing a strong tailwind for the glass insulator market.

8.3 Asia-Pacific Market: The Epicenter of Growth

The Asia-Pacific region stands as the undisputed epicenter of growth for the global glass electrical insulators market, driven by a combination of rapid industrialization, urbanization, and massive government-led investments in power infrastructure. The region's market is not only the largest but also the fastest-growing, with a significant CAGR projected for the coming years. In 2022, the Asia-Pacific glass insulators market was valued at **USD 473.44 million**, and it is expected to reach **USD 797.01 million by the end of the forecast period**, reflecting a robust CAGR of **5.4%**. This remarkable growth is primarily fueled by the expanding power generation and distribution networks in countries like China, India, and the ASEAN nations. The region's growing focus on modernizing its electricity grids and the increasing adoption of renewable energy sources are further propelling the demand for high-quality, reliable insulators.

China, in particular, dominates the Asia-Pacific market, both as the largest consumer and producer of electricity in the world. The country's extensive investments in power infrastructure, including the construction of ultra-high-voltage (UHV) transmission lines and substations, have been a major driver of the glass insulator market. China's commitment to renewable energy is also a significant factor, with the country aiming to achieve **1,200 GW of renewable capacity by 2030**, a goal it is on track to meet five years early . This massive expansion of renewable energy capacity necessitates the development of robust transmission networks, which in turn drives the demand for high-performance insulators. The presence of a large number of domestic manufacturers, such as Nanjing Electric (BPG), Zhejiang Tailun Insulator, and Sichuan Yibin Global Group, has also contributed to the market's growth, with these companies focusing on cost-effective, high-volume production to meet the region's burgeoning demand. The Indian market is also a key contributor to the region's growth, with the country's smart grid network market expected to grow at a CAGR of over **3% by 2025**.

8.3.1 China's Dominance in Production and Consumption

China is the dominant force in the global glass insulator market, both as a producer and a consumer. The country has a vast network of glass insulator manufacturers, including major players like **Nanjing Electric, ZX Insulators, and Zhejiang Tailun Insulator** . These companies benefit from a large domestic market, a well-developed supply chain, and competitive manufacturing costs. China's rapid economic growth and ambitious infrastructure development plans have created a huge demand for glass insulators. The country's State Grid Corporation and Southern Power Grid are among the largest utility companies in the world, and they are constantly investing in new transmission and distribution projects. China's dominance in the market is expected to continue, as the country continues to modernize its power grid and expand its renewable energy capacity.

8.3.2 Infrastructure Expansion in India and Southeast Asia

While China is the largest market in the Asia-Pacific region, other countries are also experiencing significant growth in demand for glass insulators. India, with its rapidly growing economy and ambitious plans to electrify the entire country, is a major growth market. The Indian government is investing heavily in new power generation and transmission infrastructure, creating a strong demand for high-quality insulators. Southeast Asian countries, such as Indonesia, Vietnam, and Thailand, are also seeing a surge in electricity demand and are undertaking major infrastructure projects to meet this need. The expansion of the power grid in these countries is a key driver for the glass insulator market in the region. As these economies continue to grow, the demand for reliable and efficient power transmission is expected to increase, providing further opportunities for glass insulator manufacturers.

8.3.3 Market Valuation and Forecasts

The Asia-Pacific glass insulators market was valued at **USD 473.44 million in 2022** and is projected to grow at a CAGR of **5.4%** to reach **USD 797.01 million** by the end of the forecast period. This strong growth is a reflection of the region's dynamic economic development and the massive investments in power infrastructure. The market is expected to be driven by the continued expansion of the power grid, the integration of renewable energy, and the replacement of aging equipment. The Asia-Pacific region is also a major hub for innovation in the insulator industry, with manufacturers developing new products and technologies to meet the specific needs of the regional market. The combination of strong demand, a large manufacturing base, and a focus on innovation makes the Asia-Pacific region the most important and exciting market for glass insulators in the world.

9. Conclusion: The Enduring Value of Glass Insulators

9.1 Summary of Key Strengths and Applications

Glass electrical insulators have proven to be an indispensable component of the modern power grid, offering a unique combination of performance, reliability, and safety. Their key strengths include superior electrical properties, such as high dielectric strength and low dielectric loss, which ensure efficient and reliable power transmission. Their exceptional mechanical strength, derived from the tempering process, allows them to withstand the significant loads imposed by heavy conductors and severe weather. The unique advantage of transparency facilitates easy visual inspection, enabling the early detection of defects and reducing the risk of unexpected failures. Finally, their predictable self-shattering failure mode is a critical safety feature that eliminates the risk of hidden "zero-value" insulators. These strengths make glass insulators the material of choice for a wide range of applications, from the pin-type insulators used in distribution networks to the suspension strings that form the backbone of high-voltage transmission lines.

9.2 The Future Outlook for Glass Insulator Technology

The future of glass insulator technology is bright, with ongoing research and development focused on meeting the evolving demands of the power grid. The integration of sensors for real-time monitoring and predictive maintenance is a key area of innovation that will enhance grid reliability and efficiency. The development of new glass formulations and manufacturing processes will further improve the performance and durability of glass insulators, while also reducing their environmental impact. As the world continues to shift towards renewable energy, the demand for reliable and efficient power transmission will only increase, creating new opportunities for the use of glass insulators. The enduring value of glass insulators lies in their ability to provide a safe, reliable, and sustainable solution for the challenges of the future grid.

9.3 Final Thoughts on Their Role in a Reliable and Sustainable Grid

In conclusion, glass electrical insulators are the unsung heroes of the modern power grid. They are a testament to the power of engineering and innovation, providing a critical function that is often taken for granted. Their unique combination of performance, reliability, and safety makes them an essential component of a reliable and sustainable electrical infrastructure. As we look to the future, the role of glass insulators will only become more important, as they will be a key enabler of the smart grid and the transition to a cleaner, more sustainable energy future. The enduring value of glass insulators is a reminder that even the most humble of components can have a profound impact on the world around us.